Tuesday is typically blog day, but I couldn’t resist making this information available to my beautiful Jamie Lynne Creative brides as well as all the recently engaged couples who are working on setting the date and determining their wedding budget. I cannot wait to begin working with you to design the wedding stationery of your dreams…within your budget! Your day. Your style. Your budget.

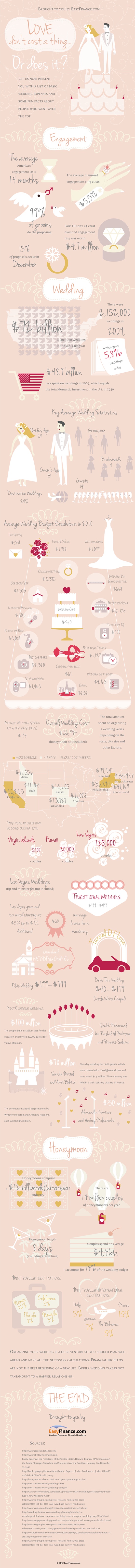

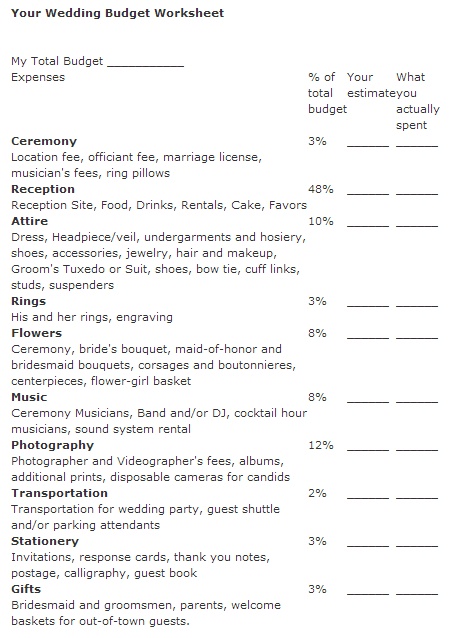

A wedding budget may {sound} like a lot of money until the costs begin to accumulate. It’s then that you realize what seem to be small expenditures add up quickly. Smart brides take steps to manage the money before costs get out of hand.

1. Choose either quantity or quality

A huge wedding with a lot of guests or a small event with only closest family and friends? A low budget for the former will require a creative venue choice and buffet or other value-priced choice of catering. Go the latter route and you can spend more per guest and still stay within a limited budget.

2. Take time for a reality check

It’s too easy to get caught up in the glamour of possibilities and begin to want, Want, WANT!! When the “gotta have it” mode kicks in, take a step back and remember what counts is the relationship and what it means, not the material things. Then take a deep breath and make meaningful choices without breaking the bank.

3. Evaluate creative talents for DIY

You, your family, and other volunteers can choose to do pieces of the wedding yourself. Centerpieces, favors, food station, the card box, photo booths, and other decorations are candidates.

4. Arrange for professional services as gifts if possible

Even the tightest budget weddings require professional services. Coordinators, photographers & planners, florists, caterers, DJ’s, officiates, and bakers all add value to wedding memories. If you are lucky enough to have any of these in your family or as friends, they may want to offer their services as gifts. Or, someone may offer to pay for one or more wedding professionals.

5. Split the costs

While more couples are footing the entire wedding bill themselves these days, splitting the bills is still an option. Parents, other relatives, friends, and others contribute to wedding costs as well.

6. Keep track of expenses all in one place and 7. earn a return on the money you spend

By charging everything to a cash back or other rewards credit card (then paying it off when the bill comes in). An example of this type of card is Discover, which gives you at least 1% back–with 5% back on specific categories each quarter–on everything you charge to the card. Just make sure you PAY IT OFF WHEN THE BILL COMES IN! 😉